Funding your year of freedom: part 1

How to think about money when preparing for your career break or sabbatical

Money.

It’s the topic I get asked about the most about my sabbatical and rightfully so. It can be one of the biggest concerns when people are considering taking a break. For so many years, we have been earning money. We end the year with more money than we started with (hopefully).

However, the sabbatical is one of the few times where it’s almost guaranteed that you end up with less. That’s why it’s not a surprise that it’s one of the biggest stressors in my life right now (which isn’t saying much considering how little stress I have now). It’s not because I worry about falling “behind” but because of choices I will have to make out of desperation: going back to work prematurely or needing to sell my investments when it is down 40%.

To make things more complex - everyone’s financial situation is different. I am very aware that I am one of the privileged ones. I had a high paying job in tech, no children and a relatively humble mortgage to pay off. Regardless, I had to still jump through a few hurdles (mostly mental) to get over the fact that I will be losing money by the end of all this. That’s why I wanted to break this big question of “how did you fund your sabbatical?” into two parts:

Part 1: how to think about money when preparing for your break

Part 2: how to streamline saving and budgeting for your break (keep an eye out for this in the next 2 weeks 👀)

How to think about money when preparing for your career break or sabbatical

Our relationship with money is complicated. Your view of it will be dependent on your personal goals, values, upbringing and financial situation. Being concrete on what money means to you will help you realise its role in your sabbatical and the informed compromises you’re willing to make.

To prepare for your sabbatical, aim to do a few exercises in these areas:

Understand your own “moneyview”

Brainstorm on how money affects your sabbatical goals

Prioritise what you need to save up for

👀 Understand your own “moneyview”

Okay, so I realised I made the "moneyview" word up while writing the blog, but it’s a concept inspired by the Design Your Life book1. Your "moneyview" is a couple of paragraphs that summarise your view of money. This view will change as you experience new things and have additional commitments in life. However, it will be a useful north star during your sabbatical (and life in general) to anchor any decisions related to money.

The exercise

Spend 15 minutes to write an answer to “what does money mean to you?”. Stick to half a page (~300 words) maximum. A few prompts that help you flesh out your answer:

What does money mean to you?

What does money enable?

How much is enough?

How does it relate to your personal values and goals in life?

How is money a priority compared to other aspects to your life?

A (shortened) example

Money is one of the tools to freedom (though not the only way) and provides comfort and security.

However, I don’t think you need to have a lot of money to be free although the lack of money can affect how easy or hard it is to be “free” especially if you are in debt or do not have the money to purchase basic necessities.

Anything above si figures helps me live the life that I want without feeling like I am sacrificing anything. Anything additional doesn’t really add anything to my level of happiness at this stage.

Money enables me to show my family love (like funding their trips overseas or taking them to a nice place for dinner) and allows me to experience new things and build character through things like travelling, trying new food or learning new skills.

Money isn’t a top priority in my life — I do not believe that money = success or happiness.

⚠️ An important note

You may do this exercise and come to a different conclusion from mine. For example, you believe money is everything and at this stage in life, you want to do all you can to earn more. And that’s totally fine! However, you have to be realistic and maybe reconsider taking a break (for now). The reality is unless you are hoping to start your own business during your break, you will end your break at a financial loss (but hopefully with lots to gain in other areas 🙂).

On the flip side, if you are aligned with my view that money isn’t one of the top priorities of your life (especially in the long-term), then maybe taking a long break is for you. All you have to do is be prepared and take the leap.

🧠 Brainstorm on how money affects your sabbatical goals

Most of us are taking an extended break because we want to travel, learn new things or improve our health. Whatever your goal for your sabbatical is, it’s likely that you’ll need some money for it (on top of any existing costs to simply live).

In this exercise, you will be mapping out different ways to achieve your goals and assess which ones are very money-dependent (such as travel) and which ones have cheaper alternatives to achieve the same goal.

The exercise

Write up your goal(s) for your break (note that some of your goals might not need money at all)

Brainstorm multiple ways you can achieve those goals and start to estimate the costs

Map out rough priorities — these will be the top priorities/things you will be saving for

An example

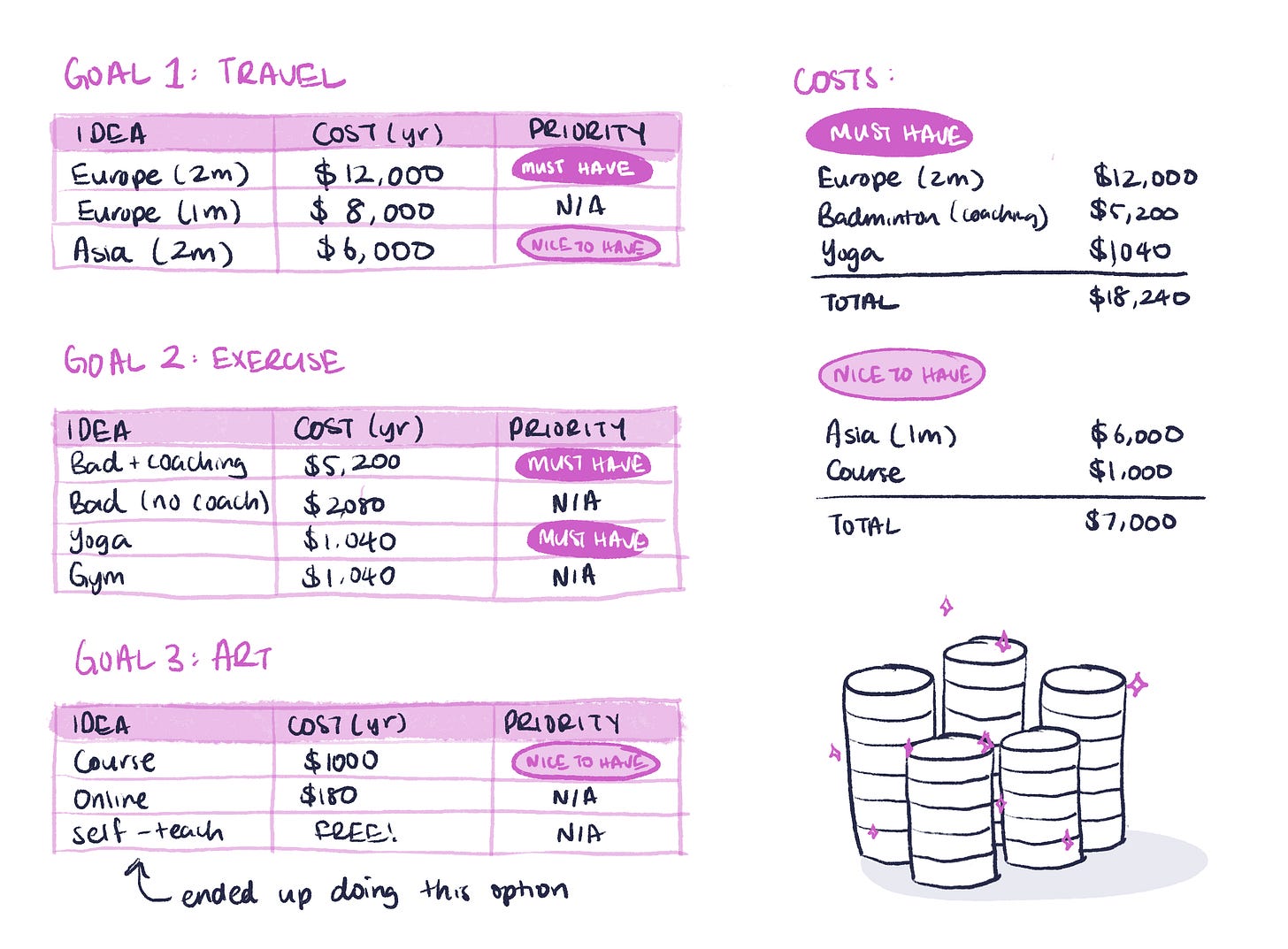

In this example, you can see that I broadly mapped out my goals in priority order: travel → exercise → learning art. When you start mapping out the possible ways to reach those goals, you will realise that there are many options with varying prices.

It’s important to note that I am not telling you to choose the cheapest option. I know for a fact that if I chose the “gym membership” option, I will never exercise. However, mapping out the costs will allow you to make a more informed decision on what you’re willing to compromise on (as discussed in the next section).

🏷️ Prioritise what you need to save up for

It’s not a post by a product manager if I don’t mention the word prioritisation at least once. Now that you have a list of ✨ all the things ✨ you can do during your break, we need to prioritise.

The exercise

Assess each of your ideas by considering (1) the priority of the goal, (2) effectiveness andm(3) cost.

Before you prioritise your ideas, prioritise your goals. If you’re like me, you probably have multiple goals (in my example, it was exercise, learning art and travel). However, we know that we probably won’t hit all of those goals, so if you were to choose one goal to invest in(energy and money-wise), which one would it be?

For effectiveness, you need to make sure that the idea will help you reach your goal. For example, if your goal is to exercise 5 times a week and you can achieve it by going to the gym or a team sport but you know that you hate the gym (even though it’s cheaper), then choose the latter.

For good measure, mark max 3 items as “must-have” and 2 items as “nice to have”. The “must haves” now become your minimum saving goal to have a solid break and the “nice to haves” is the extra things you could do if you just saved a bit more.

An example

In this example, I am putting in the most money (which happened to be the most effective idea) in my top two goals and chose the “free” option for my lowest priority goal. The time, money and energy you invest should align with your priorities.

💁🏻♀️ Being tighter on money isn’t a bad thing

The last remaining piece of advice I will give is to remember that being tight on money isn’t a bad thing. When you have recurring income, it gives you this safety net or excuses to not start that thing. I remember my most creative years were when I was a starving uni student. I needed money, so I learnt many new skills to earn income.

Having a fixed amount of cash has also allowed me to be more intentional with what I spend. Now, I appreciate every meal and purchase I make. It has even allowed me to form healthier habits: cooking more and walking more.

Hopefully, by the end of these exercises, you have learnt a bit about your relationship with money. Of course, this is only the first step in funding your year of freedom. In our next post, we’ll be going deeper into the number side of things and how to streamline your savings.

See you all soon! 👋

Sabbatical Highlights (Week 3 & 4)

How has it already been a month? I focused on doing a bit less in the last two weeks, especially since I was settling into a new part-time role.

👩🏻🏫 Started teaching at UNSW which has been more tiring than I remember but a lot of fun!

🎨 Finished my first piece of artwork on Procreate!

🏋🏻 Exercised a lot. Maybe too much. I deadlifted for the first time!

☕️ Coffee chats and lunches with friends (new and old) in the tech ecosystem — slowly regaining my passion for the space.

☀️ Finally did something outdoors-y and walked the Hermitage Foreshore walk with a friend. Good vibes.

Design Your Life | A great book that walks you through exercises to improve life using design thinking principles.

Hi Jenny, found you through the Sabbatical Project! Thanks so much for writing this post. I’m gearing up to take a career break and focus on my art practice next year and planning for it has brought up a ton of money feelings! The moneyview exercise you suggest seems really useful 🌟

Another great post, loving this blog Jenny! Especially how it always seems to dig into philosophy about important topics eg around work, money, time etc. At the risk of suggesting another pod you may like (!!)... i'm a huge fan of Seth Godin's work, and this riff on money as a story we tell ourselves is one i've saved w/ timestamps. SO good. Listen from 1:06:05 where TIm Ferris asks him about the opportunities he was offered but turned down... he goes into this amazing riff on money as a story https://open.spotify.com/episode/0iGatidn9jAm4Gio7TA3F2?si=UASLPo9WTQuxXA06xV8q5Q