Funding your year of freedom: part 2

How to calculate how much you need and save for the career break of your dreams

It’s 2015. I am a poor uni student: working multiple jobs to pay rent, save for my Japan trip and sustain somewhat of a social life. I recorded every single expense and even quit coffee to save an extra $2000 a year.

Budgeting sucks.

And… I definitely didn't want to find myself in that situation again when I started planning my break. That's why when I put numbers into a spreadsheet, I wanted to make sure I had enough money to:

Not stress out about purchasing things I valued. For example, gifts, coffee, hanging out with friends, travel, health and education.

Take spontaneous trips or education courses I wanted to do in the latter half of the year.

Continue to pay off my fixed costs such as a mortgage, strata, council fees and insurance.

After months of planning, saving and spending, I'm sharing some tips and tricks to make your sabbatical stress-free.

Note: this article assumes you have read part one of the “Funding Your Year of Freedom” series where we talk about how money affects your sabbatical goals and mindset. I highly recommend reading it beforehand!

🧮 So, how much do you actually need?

The answer to most complicated questions (like this one) is: it depends. The grand total you need to save up for your sabbatical depends on:

Your monthly fixed & variable costs: how much you spend today to sustain your lifestyle

Your sabbatical goals: while some of your goals could be completely free, it’s more likely that they are not.

Length of your sabbatical: the longer you want to take time off, the more planning and savings you need.

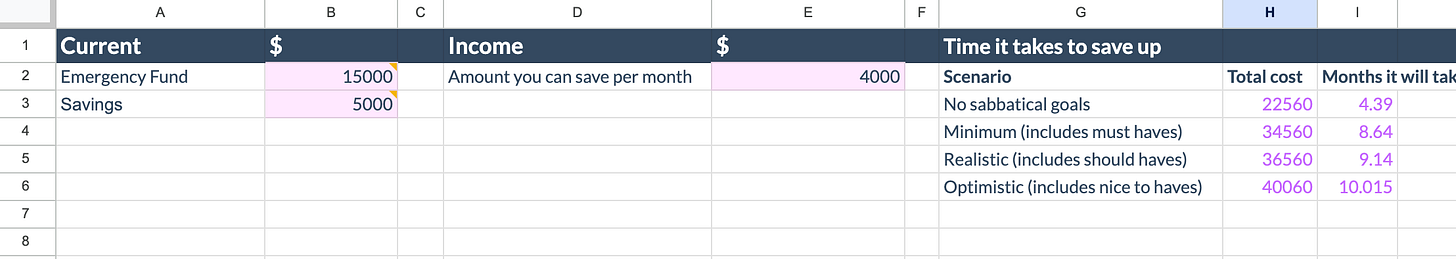

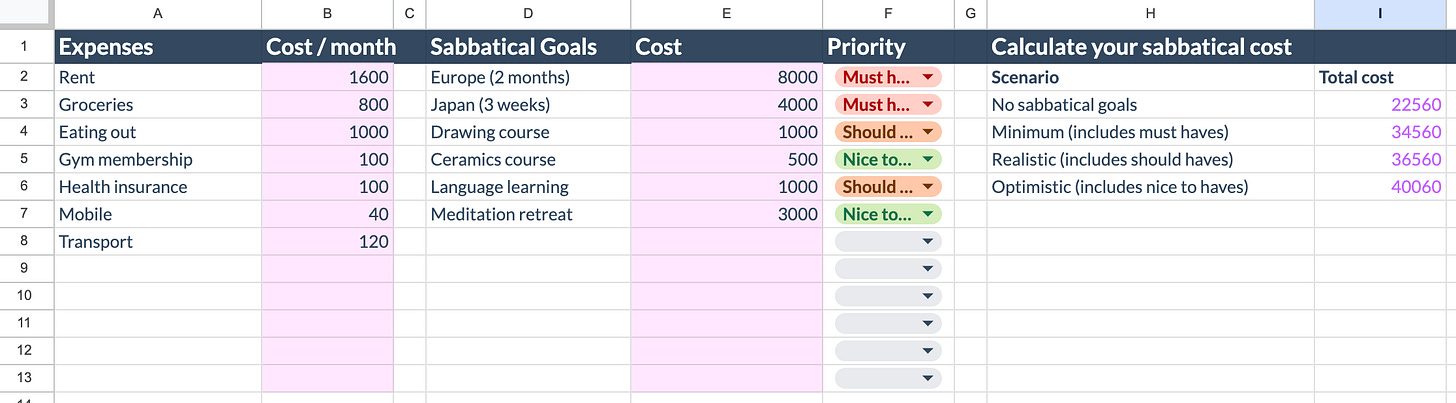

To get a rough ballpark number, I created a simple calculator on Google Sheets that you can download now:

Calculate the costs of your sabbatical by downloading my template:

To calculate the cost of your sabbatical:

Select your desired sabbatical length. If you’re not sure about whether you want a 6 or 9 month sabbatical, I would put the longer length in. This will help build a natural “buffer” to your budget.

Estimate your monthly costs. Start with the fixed costs (rent, insurance, ongoing bills, groceries). Then, average your monthly variable costs (eating out, shopping, hobbies). Try to reference your bank statements over the past 3 months for the most accurate number.

Estimate the cost of your sabbatical goals (and prioritise them). Break down your goals. For example, if you want to travel, break it down to different destinations and estimate the cost. Then, prioritise all your goals using labels “must have”, “should have” and “nice to have”.

Calculate your magical number! The spreadsheet contains 3 different scenarios based on your sabbatical priorities. This allows you to aim for a range rather than a fixed number, which makes the process a lot more flexible..

Minimum: includes the cost of the “must haves”.

Realistic: includes the “must haves” and the “should haves”.

Optimistic: includes all your sabbatical goals!

🪙 Saving up for your sabbatical

Now that you have your magical number(s), it’s pretty easy to figure out how long it'll take you to you can save up. It’s a function of:

How much money you have right now: make sure to exclude your emergency fund! The emergency fund will come in handy. I have already dug into my emergency fund this year to pay for bills that I forgot existed (damn you, car insurance 💢).

How much you can put aside for your sabbatical per month: this is dependent on how much you can afford. For me, I put most of my salary into saving up for my sabbatical to prioritise taking a sabbatical sooner.

The reason I had 3 different scenarios (and hence 3 different numbers to aim for) is for making tradeoffs. For some people, they might be able to wait longer to take the ✨ perfect ✨ sabbatical. For others, they're willing to give up that meditation retreat or Japan trip to take the sabbatical sooner.

💵 Taking a sabbatical isn’t a wise financial decision

I ain’t no personal finance guru but I do know that taking a sabbatical is going to pause your financial goals. Not only are you not earning income, but you are also spending money that could have gone into investments. That’s why it’s critical that you’re aware of the tradeoffs you’re making. For transparency, a couple of tradeoffs I made were:

Going from investing ~50% of my income (ETFs, stocks or real estate) to 0% in the last ~9 months, which pushes back several financial goals by ~1-2 years.

No longer being able to shout my family fancy meals or travel as often, which was actually the toughest thing to reconcile. But, I substituted this with spending more quality time with them.

Not going out to nicer restaurants or drink as much as I used to. Although, this was the easiest tradeoff out of them all.

It also goes without saying... anyone able to consider a sabbatical is more privileged than most. That in itself has helped me make peace with it. I also know that my own personal fulfilment and happiness is greater than any financial loss.

A wise mentor summarised this for me pretty well:

At the end of your life, will you remember the extra 6 months you worked or will you remember the 6 months you took time off to explore the world?

And if taking a whole year scares you, start with something as small as 2 months!

✨ Extra tips, tricks and thoughts to make funding your year of freedom easier

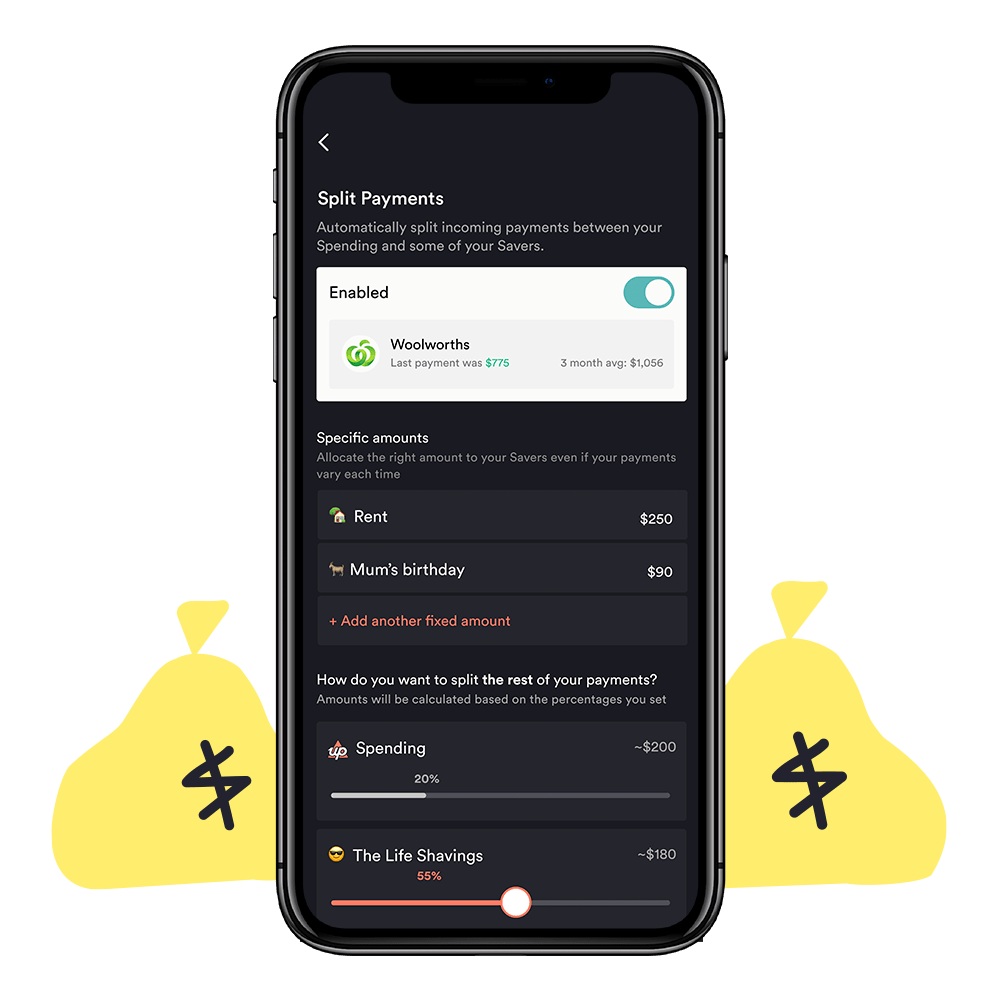

💁🏻♀️ Tip: automate your saving using Up

Leverage technology to automate saving money! If you know me personally, you will know how much I love Up Bank. In particular, I use their “Pay Splitting” feature that automatically splits my pay-check every time it comes in.

Beyond saving for your sabbatical, Up has simplified my personal finance life tenfold. Abi wrote a great deep dive on this very topic if you’re interested in this space.

🪄 Trick: time will save you money

We’ve heard the saying that money can buy you time, but have thought about how much money you could save if you just had the time? Your costs probably assumed your current spending habits. Things like buying lunch, transport and Friday night drinks.

The good news about all of this is that you will reduce your spending costs simply by having more time. Time allows you to do things that you previously paid for. For example:

Making my own coffee instead of buying ~2 coffees a day.

Making my own lunch for most days of the week instead of buying lunch.

Walking to places more and taking transport less often.

💭 Thought: embrace unpredictability

Ha. Maybe I’m the one that needs to hear this the most. But shit happens. You do all this amazing planning and then 💥 BAM 💥 in comes your car insurance bill, unforeseen health issues or random family commitments.

If you’re anything like me, my initial reaction is to stress out, find ways to make more money or reduce my spending habits. But don’t be like me. DON’T PANIC! Embrace it. After all, these are gentle reminders on the value of money. If you do run out, there will be ways to gain it back. 💜

Week 7 & 8 Sabbatical Highlights

Not going to lie, didn’t have a very eventful 2 weeks because I spent most of my time marking uni assignments. 😅

☀️ Made the most out of the remaining days of summer by going to a few beaches.

👩🏻💻 Engaged a lot with the tech community! Doing mentoring sessions through MentorCruise and providing advice to early stage startups. It’s been fun learning about new problem spaces!

🎉 Lots of celebrations including my husband’s birthday and our anniversary. Crown Sydney is kinda overrated. Whoops, I said it. 🤐

🌱 More domestic goddess goodness. Learning how to propagate plants so that I can create an indoor plant JUNGLE!

Very interesting and making me reevaluate my own financial decisions. If you don’t mind please breakdown the 2 months Europe $8k for me because I must be doing something wrong to be spending so much more…

Great content, very thought provoking. Have you looked into any other mentoring platforms other than Mentorcruise? I just signed up to be a mentor!